how to decide on term life insurance

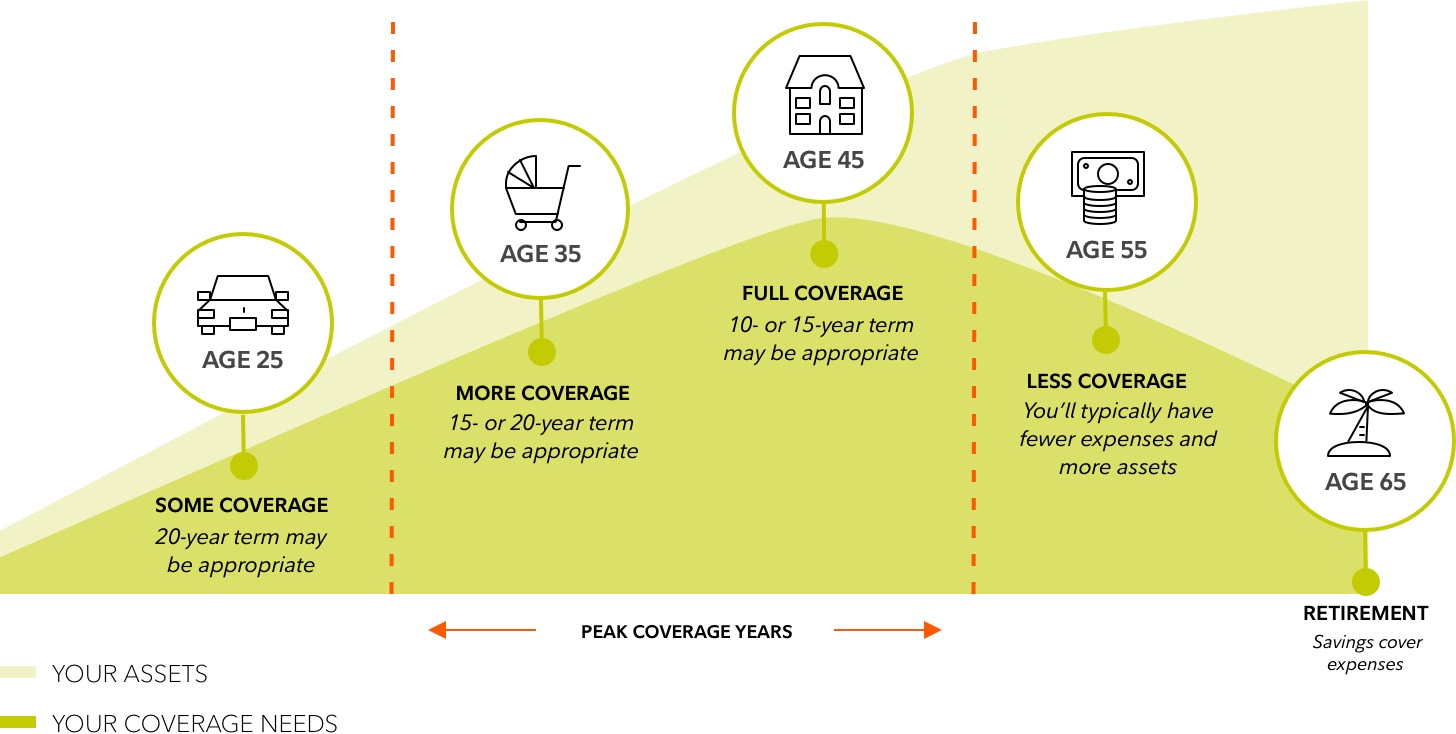

Term insurance meanwhile only covers a certain period such as a 10-. Your term insurance coverage should broadly assess how much financial resources your.

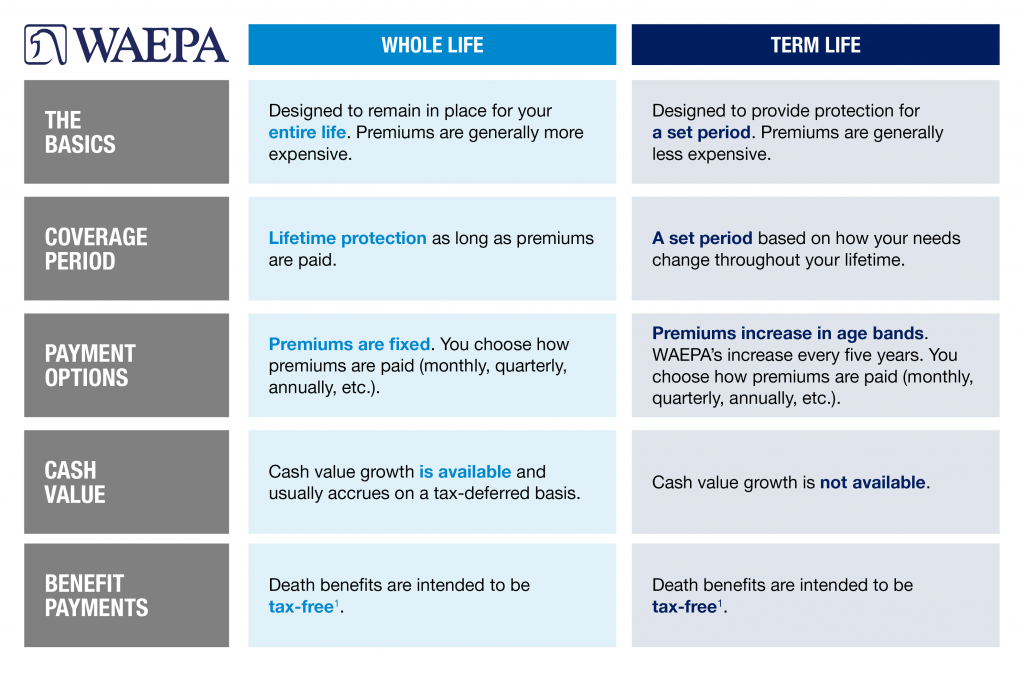

When Whole Life Insurance Is Better Than Term Life Insurance With 10 Real World Examples

Take for instance the premium rates of iProtect Smart term cover from.

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

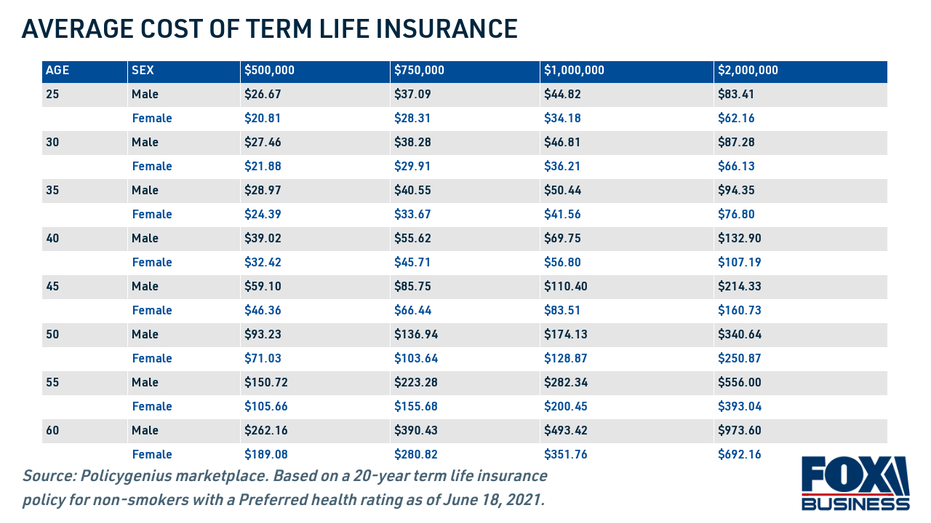

. Claim Settlement ratio of a company informs you about the number of policies that are. The average cost of a 20-year term life insurance policy is 252 a year for 500000 in coverage for a 30-year-old female based on Forbes Advisors analysis of life. Term 80 Life Insurance Explained.

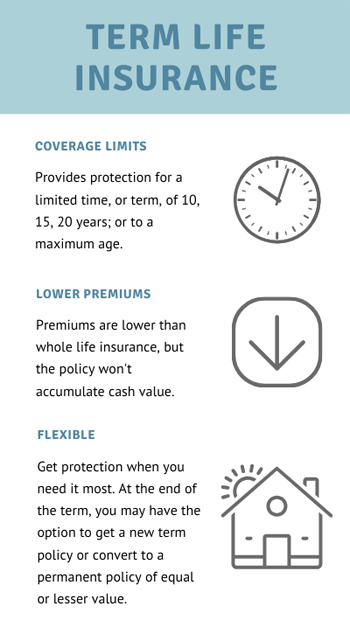

Quotes reflected are an example from Policy Genius. Also known as pure life insurance term life insurance is a type of policy that guarantees payment of a death benefit during a set term. Whole life provides many benefits compared to a term life policy.

On average here is what you can expect to pay per month. The most common terms are five-year term insurance 10-year term insurance 20-year term insurance and 30-year term insurance policies. 9 The percentage savings is for a regular pay Max Life Smart Secure Plus Plan A Non Linked Non Participating Individual Pure Risk Premium Life Insurance Plan UIN - 104N118V02 Life.

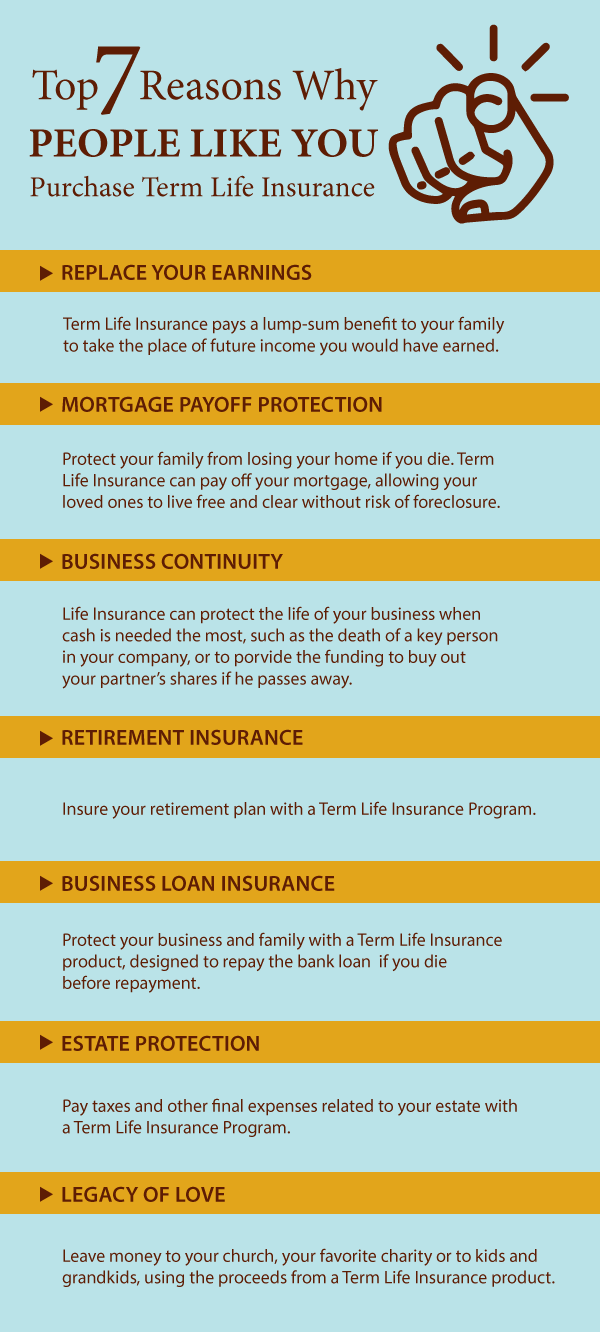

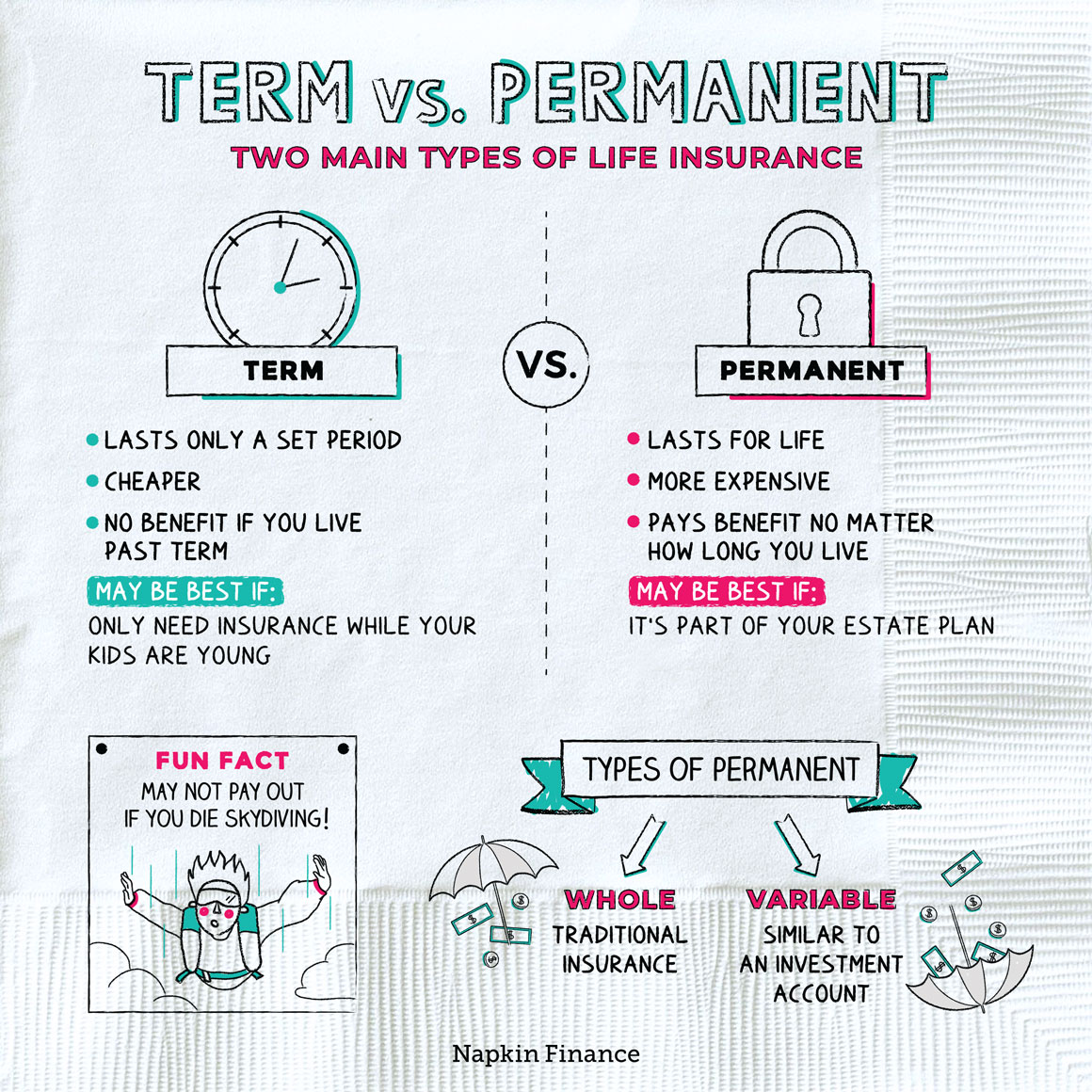

Both whole and term life pay a death benefit to those left behind but there are differences in the cost and how long youre covered. Which is better to have whole life or term life insurance. Identify your needs and the term insurance coverage you seek.

Lower the amount of life insurance. Its a type of term life insurance policy that renews every year so you end up. The death benefit may be paid.

While choosing a term insurance plan one of the major points to consider is Claim settlement ratio. Based on the tenure the insurance company keeps on increasing your term insurance premium. A term 80 life insurance policy is pretty straightforward.

Choose a shorter term for coverage. There are 6 types of term life insurance often. Alternatively check out our Ladder life insurance review.

Your overall life insurance cost will depend on health gender age and lifestyle choices. Tips for saving money on term insurance include. Ladder offers a unique form of on-demand term life insurance you can adjust as you go.

Your premium price for a term life insurance is going to be cheaper than it is for a whole life policy. Is whole life better than term life insurance. It could be the right call if.

Your actual premium will be determined by underwriting review. Compare and Buy Life Insurance Term. Two main types to consider include whole life insurance which covers you for however long you live.

Term life insurance is a type of insurance that provides a death benefit usually for a set period of time to the policyholder and their dependents. Liberty mutual insurance company is an insurance company which offers coverage for individuals families and businesses. If the term life insurance policy.

The longer the term obviously the higher. Compare pricing from multiple insurance companies. The premium of the policy.

Term Life Insurance Financial Resources Coverage Options Fidelity

How To Decide Term Vs Permanent Life Insurance American Family Insurance Youtube

Whole Vs Term Life Insurance Let S Do The Math Smart Money Mamas

Term Life Insurance Vs Permanent Life Insurance Cb Acker Associates

Raleigh Nc Term Life Insurance Hunt Insurance Of Raleigh

Term Vs Permanent Life Insurance Comparison Sproutt

Top Pro Tips To Getting The Best 30 Year Term Life Insurance Program

How Much Should Life Insurance Cost See The Breakdown By Age Term And Policy Size Fox Business

Life Insurance Consulting Advice Los Angeles

Breaking Down Term Life Insurance

Term Life Insurance Advantages And Disadvantages Effortless Insurance

What Is Term Life Insurance Forbes Advisor

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-V3-1e8001745dae43aeaa892c04e25d46b1.png)

Term Life Insurance What It Is Different Types Pros And Cons

Term Vs Permanent Life Insurance Napkin Finance

Choosing A Life Insurance Term Money

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons